RBI’s latest report also shows local Indian banks are among the healthiest in decades, even as smaller lenders gain market share.

why the Reserve Bank of India’s latest report describes local Indian banks as the healthiest in decades, while smaller lenders have gained market share, and what this means for the Indian banking sector, the economy, customers, and policy makers. This summary draws on the latest available data and analysis from the RBI’s Trend and Progress of Banking in India 2024-25 report as of March and September 2025, and related expert and news commentary.

- Why This Reserve Bank of India Report Matters

The Trend and Progress of Banking in India report is the most comprehensive annual regulatory assessment of the Indian banking system. Compiled by the RBI, it assesses the health, performance, and structural evolution of the banking sector—including public, private, foreign, and specialized lenders—based on balance sheet data, asset quality trends, profitability, market share, regulatory developments, and emerging risks.

The December 2025 release has information about what happened from March 2025 to September 2025. It tells us some things, about the December 2025 release. The December 2025 release is pretty useful because it has key things we should know.

Indian banks are financially healthier than they have been in decades.

The quality of assets is really good now. It is better than it has been in a long time actually the best it has been in many decades. The asset quality has gotten to a point that’s as good as it was many years ago which is a very low point, for bad assets. The asset quality has improved to levels that’re the lowest in many decades.

Some lenders are not very big. They do a specific job, like small finance banks and payment banks. These smaller lenders are getting customers and that means they are getting a bigger part of the market. Small finance banks and payment banks are really gaining market share.

The banking landscape is evolving rapidly due to technology, competition, inclusion, and regulatory changes.

It is really important to know about these trends because banks are the backbone of Indias system. The Indian economy depends on banks. Banks help with investment and economic growth. They also give loans to people and businesses. If banks are stable then the Indian economy can handle problems without falling apart. Banks are very important, for the economy.

- The Health of Indian Banks: Strong Fundamentals

2.1 Record Low Bad Loans (Non-Performing Assets)

A bank is really healthy if people who borrowed money from it are paying back what they owe. One thing that shows if a bank is doing well is its loans. These are loans where people are not paying the interest or the actual amount they borrowed. We call these loans non-performing assets or NPAs for short. Non-performing assets are a problem for banks because they mean that people who got loans, from the bank are not paying back the money they borrowed. So non-performing assets are a sign of a banks health.

According to the latest RBI data:

The gross NPA ratio for Indian banks fell significantly––to around 2.1% by September 2025, compared with 2.2% in March 2025. This is one of the lowest levels in decades.

The bank is getting better and better at making loans. This is because they are very careful when they give people money. They also do a job of getting their money back when people cannot pay them. The bank is being smart about how money they lend to people. This is what is helping the bank to keep improving. The banks strong loan underwriting and recovery efforts are really working well. They are also being very careful, with credit growth, which is helping the bank to continue to get better.

A low NPA ratio is really important because it means that the bank has bad loans. The NPA ratio is something that banks have to pay attention to. A low NPA ratio is good for the bank. It is good for the people who put their money in the bank.

- The bank has money that it will not get back from borrowers

- The bank is able to make loans to people who need them

A low NPA ratio shows that the bank is doing a good job of making sure that people can pay back the money they borrow. The NPA ratio is a deal, for banks and a low NPA ratio is what they want.

Banks do not have to deal with loans so they have more money to lend to people who will use it for good things like starting a business or buying a house. This means banks have the freedom to lend money to people who really need it such, as those who want to start a project because bad loans are not taking up all the money that banks have. Banks can use their money for lending, which is lending that helps people do something useful like create jobs or make new products and this is what banks like to do with their money because it helps the bank and it helps the people who borrow the money from the bank and this is what is meant by productive lending.

The company makes money because it does not have to spend as much on bad assets. This means profitability of the company improves. When the company has assets it has to set aside money for them, which is called provisions for bad assets. Now the company has to spend money on provisions, for bad assets so profitability of the company improves.

When people have stability it is a good thing. This happens because there are loans that may not be paid back. So financial stability increases because fewer loans are at risk of default. This means that financial stability is good for everyone especially when there are loans that may cause problems. Financial stability is important. It increases when people are able to pay back their loans and fewer loans are, at risk of default.

This trend is a stark contrast to the banking stress seen in earlier decades (especially around 2017–2019), when NPAs from infrastructure and corporate loans weighed heavily on banking balance sheets. The current levels suggest that Indian banks now face much lower credit risk than before.

2.2 Strong Capitalization and Liquidity

Capital adequacy and liquidity are two more pillars of bank resilience.

The numbers are a little different depending on where you look. The latest report, from the Reserve Bank of India which is the RBI showed that:

Banks did a job of keeping a lot of money set aside. They had plenty of capital to meet the requirements that the government set. The capital adequacy ratios of banks were, above what the government said was the minimum. Banks kept their capital adequacy ratios high.

The liquidity coverage ratios and the leverage measures had good buffers, which is a good thing, for the liquidity coverage ratios and the leverage measures. This means that the liquidity coverage ratios and the leverage measures are doing well.

Banks are safer because they have these buffers. These buffers help banks deal with problems like when people cannot pay back their loans all of an when the economy gets bad. The strong buffers make banks better able to absorb shocks such as loan defaults or economic contraction. Banks can handle things, like loan defaults because of these buffers.

Indian banks have money to pay what they owe even if something unexpected happens. They are ready for any situation. Indian banks are, in a position because they have a lot of cash and Indian banks can use this money to deal with any problems that come up. Indian banks will be okay.

This is a testament to the RBI’s prudential regulation and risk-based supervision, which insist on strong capital buffers and conservative provisioning.

2.3 Profitability and Growth

When we look at how good a banks assets how much money they have it tells us if the bank is safe. The banks profitability shows us how well the bank turns its work into money that the bank can keep as earnings. This is important for banks because it shows how well they do their business operations and turn that into earnings, for the banks.

Key points from the report and market assessments:

The banks are doing well with their Return on Assets and Return on Equity. These numbers are good which means the banks are making an amount of money from what they own and the money that people have invested in them. The Return on Assets and Return, on Equity are important because they show how well the banks are using their assets and the money from shareholders to make money.

Deposits and credit continued to grow in double digits, though at a slightly moderated pace compared with previous years.

The fact that banks are making money and growing at the time is a good sign. It means that banks are steady and also getting bigger in a way. Banks are growing because people and businesses want to borrow money from them. Banks are also coming up with ideas, for products and services. This is helping the banks to grow more.

- Smaller Banks and New Entrants: Gaining Ground

3.1 Market Share Shifts

The Reserve Bank of India report also pointed out that there is a change in the market share, within the banking sector:

Big banks, like the public sector banks and the large private sector banks did not see a change in the share of the total banking balance sheet. The share of the banking balance sheet, for these traditional large banks went down a little.

Smaller lenders — including foreign banks, small finance banks (SFBs) and payment banks — gained incremental market share.

This change is a deal, for the Indian banking system. It is really going to change the way things work. The Indian banking system is going to be very different.

Indian banking has been controlled by a few banks for a very long time and most of these banks are owned by the government.. Now new banks and special kinds of lenders are taking a bigger part of the Indian banking market. Indian banking is. New entrants are getting a larger share of the Indian banking market.

3.2 Who Are These Smaller Lenders?

Some smaller lenders are getting bigger. They include:

Small Finance Banks such as AU Small Finance Bank, which began as niche lenders and now provide broader products to retail, micro, and small business customers.

Payment Banks (licensed to take deposits and facilitate payments but not lend extensively).

Non-bank financial companies (NBFCs) with banking partnerships or co-lending arrangements.

These institutions usually focus on:

Micro and small business lending

Retail and rural banking

Digital or payment solutions

These companies are doing well because they can change quickly and they like to do things. This means they can help people that regular banks do not help. They have a business model and it is often digital-first which is why they can serve people that traditional banks are not serving. These digital-first business models are really helping them grow.

3.3 So why are these smaller lenders becoming more popular? The thing is smaller lenders are growing. That is what we want to talk about, why smaller lenders are growing.

There are a things that explain why things are changing like this:

- Regulatory Reforms → Expanded Licensing

The Reserve Bank of India has made rules for finance banks and payments banks. This is so that more people can get bank services and there is competition, between banks. The Reserve Bank of India wants to help people who do not have bank accounts. The Reserve Bank of India is doing this to make sure everyone can use bank services. This will help finance banks and payments banks to grow and help more people.

These lenders are made to help people that big banks do not usually serve, like small businesses and families that do not have a lot of money. The lenders are doing well. That shows that the changes that were made are working. These lenders are really good for enterprises and low-income households because they give them the help they need. The growth of these lenders shows the success of these reforms. That is good, for small enterprises and low-income households.

- Technology and Digital Banking

Smaller lenders are usually the ones to start using new technologies. They do this faster than the lenders. New technologies are really important, for lenders.

Mobile banking platforms

UPI and digital payment integration

Instant loan approvals with automated credit assessment

The digital edge is really important, for these companies. It helps them grow faster. They can also get customers who like to do things quickly and easily. These customers do not want to go to a bank branch. They want convenience and speed when they do their banking. The digital edge gives them that.

- Focus on Untapped Markets

Big banks usually care about working with companies and big stores. Smaller lenders target:

- businesses

- people who do not have a lot of money

- folks who need a little help with their money. Smaller lenders really focus on clients, like these people and small businesses.

Rural and semi-urban customers

Micro and small businesses

Low-income individual borrowers

People really need banking services in these groups. The smaller banks are doing a job of giving these people what they need than some of the big traditional banks. Banking services are in demand and the smaller lenders are taking advantage of this demand, for banking services.

- Strong Capital Inflows and Funding

Many smaller banks have benefited from:

- Lower costs

Many smaller banks have found that they have costs.

- Better service

Many smaller banks are also providing service to their customers.

This is what many smaller banks are doing. Many smaller banks have good things going for them.

Many smaller banks are doing a job of helping people.

Equity capital from investors

Strategic partnerships with fintech firms

Co-lending arrangements with larger banks

This money helps the company give loans and get more customers. The funding is used for credit expansion and market penetration. This means the company can offer credit to people and also get into new markets. The funding is really important, for credit expansion and market penetration of the company.

- Implications for the Banking Sector and the Economy

4.1 A More Competitive Banking Landscape

When smaller lenders get a piece of the market it means there are more people trying to loan money. This has a lot of effects, on the lenders and the people who borrow from them. Some of these effects are:

- Better Services and Lower Costs

Competition usually makes banks do a things. They have to try to be better than the banks.

- Lower the fees they charge people for using their services

- Give people a deal when they borrow money from the bank

- Make it easier for people to use the banks services.

Competition between banks is really important because it makes banks think about what the people who use their services need from a bank. This helps banks to come up with ideas and to make their services better. Competition between banks is good for people who use the banks because it means they get a service, from the banks.

Improve customer service

Reduce costs for banking products

Innovate faster

People who buy things from a company get these things from the company:

More choices

Better interest rates

Enhanced digital experiences

- Pressure on Traditional Banks

Big banks are facing competition now in areas where they used to be in charge. This is happening in places, like:

Retail and SME lending

Digital payments

Small business banking

The competitive pressure is really good, for efficiency it makes things work better.. It also forces traditional banks to change and become more modern to keep up with the times like other modern banks.

4.2 Enhanced Financial Inclusion

The Reserve Bank of India has a plan for the future. This plan is to make sure everyone in the country has access to banking services. The Reserve Bank of India wants to make sure that people who do not have a lot of money and people who live in areas can also use banking services. The Reserve Bank of India is working to make this happen so that the Reserve Bank of India can help all people, in the country.

Smaller lenders—especially small finance banks and payment banks—are critical to this effort because they:

Reach underserved areas

We should make products that’re just right for people who do not have a lot of money. These products should be made with low-income customers in mind. Low-income customers need things that’re affordable and useful to them. We can offer products that’re perfect, for low-income customers and help them out.

We should use platforms to make services easy to access for everyone. This way people can get the services they need from the platforms. The digital platforms will make the services accessible.

The RBI report noted increased credit to self-help groups and joint liability groups, which further supports inclusion objectives.

4.3 Economic Growth and Credit Flow

Healthy banks can do a lot of things for the economy.

They can support the economy by

- lending money to people who need it

- helping businesses grow and create jobs

- making it easier for people to buy homes and cars

Healthy banks are very important, for the economy because they provide the money that people and businesses need to do things.

Healthy banks can also support the economy by being safe places for people to put their money.

Extending credit to productive sectors

Businesses need help to invest and expand. This is what we do. We help businesses to invest and expand. Our goal is to assist businesses in investing and expanding their operations. Businesses that invest and expand are able to grow and become more successful. So we are here to help businesses invest and expand.

Supporting consumer spending

Indian banks have a lot of money set aside. They do not have many bad loans. This means Indian banks are, in a position to help people and businesses get the money they need to grow without taking on too much risk. Indian banks can support credit growth because of this.

The deposit and credit growth did slow down a little. The deposit and credit growth was still really strong. This shows that the deposit and credit growth is still getting bigger and better.

- Risks and Continuing Challenges

The RBI report shows that things are generally good. It also points out some areas where the Reserve Bank of India needs to be careful. The Reserve Bank of India report is mostly positive. The Reserve Bank of India also needs to watch out for a few things.

5.1 Monitoring Stress in Niche Segments

The RBI has urged microfinance institutions and lenders in smaller segments to monitor stress buildup, as over-leveraging in borrower segments can lead to potential future defaults.

This is particularly relevant because:

Micro loans and small loans usually have a lot of risk. When you give someone a loan or a small loan there is a bigger chance that they will not pay you back. This is because people who need loans and small loans often do not have a lot of money to begin with. So micro loans and small loans are really risky, for the people who give them.

Borrowers in underserved segments may be more sensitive to economic shocks

Managing risks is really important for things to stay stable over a time. This is because risk management helps with long-term stability. So effective risk management is necessary.

5.2 External Risks and Economic Headwinds

The bank needs to be strong so it can handle problems that might come from outside like:

Global slowdown

Geopolitical uncertainties

Commodity price volatility

Although the domestic system is currently healthy, external spillovers can still impact credit demand or asset quality indirectly. Historical RBI reports suggest the banking system remains vigilant against global risks.

5.3 Non-Bank Financial Company (NBFC) Stress

Non-bank lenders have sometimes faced asset quality pressures, especially in microfinance and NBFC segments. An RBI Financial Stability Report highlighted some concerns about rising stressed assets among NBFCs.

This thing does not really hurt the bank. It does show that other parts of the financial system need to be watched and that people need to work together to reduce risks to the financial system. The bank is not the thing that needs to be looked at the financial system, as a whole needs to be supervised and the financial system needs to have coordinated risk mitigation. The financial system is what we are talking about here and the financial system needs to be protected.

- Policy and Regulatory Significance

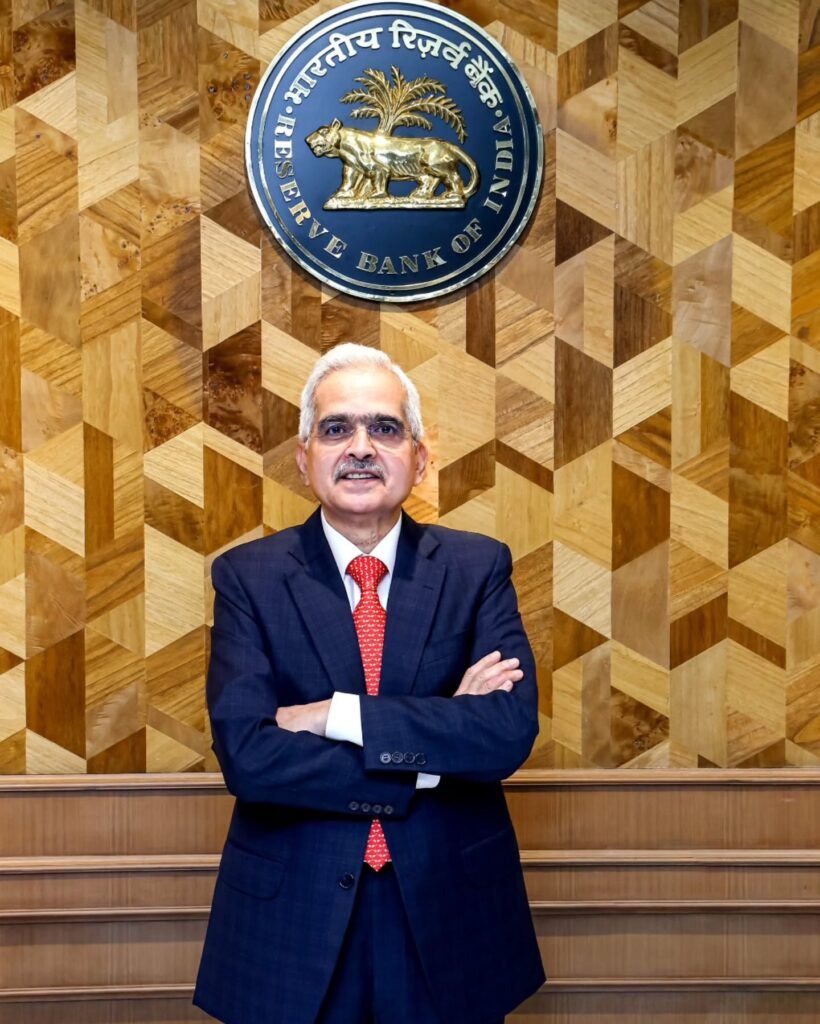

The Reserve Bank of India management of the banking sector has been really important for the banking sector to be, in a state. The Reserve Bank of India has played a role in this. The banking sector is doing well because of the Reserve Bank of India stewardship.

6.1 Prudent Regulation and Supervision

Some important things that regulators do include:

- They make sure people follow the rules

- They check that everything is working correctly

Key regulatory actions include things like making rules and checking that people are following the rules. Key regulatory actions are very important, for keeping everyone safe.

Strengthening capital adequacy norms

Risk-based supervision

Encouraging digital banking infrastructure

Tailored guidelines for new entrants

These policies have things that are part of them. The policies include things like

- rules that people need to follow

- guidelines, for situations

The policies have a lot of details. These policies have information that’s important to know.

Improved risk management

Encouraged innovation

Strengthened financial stability

6.2 Financial Inclusion Initiatives

The Reserve Bank of India has really helped people by making small finance banks, payment banks and rural banks grow. This has brought the Reserve Bank of India closer to its goal of including people in the banking system. The Reserve Bank of India is making progress, with its inclusion goals.

Initiatives like expanded credit to self-help groups affirm that efforts to bring more citizens into the formal banking fold are yielding results.

6.3 Dealing With Challenges That Come Up In The Future

We have to think about how we can handle the situations that the future will bring. The future is going to be full of challenges. We need to be ready, for them. Adapting to challenges is very important. We must learn how to adapt to challenges. This will help us to stay strong when we face challenges in the future. Dealing with challenges is something we all have to do.

The report also talks about what the company should look at in the future things like:

Cybersecurity risks

Climate change impact on financial systems

Responsible tech adoption

Structural reforms for long-term resilience

This forward-looking guidance shows the RBI is not just assessing current health but preparing the system for future challenges.

- Conclusion: A Banking Sector on Firmer Footing

To summarize:

The Indian banking sector is among the healthiest in decades, with record-low bad loans, strong capital positions, and sustained profitability.

Traditional banks remain robust, but competition from smaller and specialized lenders is reshaping the banking landscape, improving innovation and financial inclusion.

There are still some risks that we need to think about especially when it comes to microfinance and things that are happening in the economy outside of our control.. Overall the future of microfinance looks good and it can handle problems that come up. This is because the people, in charge are making decisions and the system is being improved with structural reform. The regulation of microfinance is also being done in an thoughtful way, which helps to support it. Microfinance is supported by this regulation and structural reform.

This evolution reflects not just quantitative improvements in banking metrics but also qualitative changes in how banking services are delivered in India—pointing to a future where the financial ecosystem is more inclusive, competitive, and adaptable.