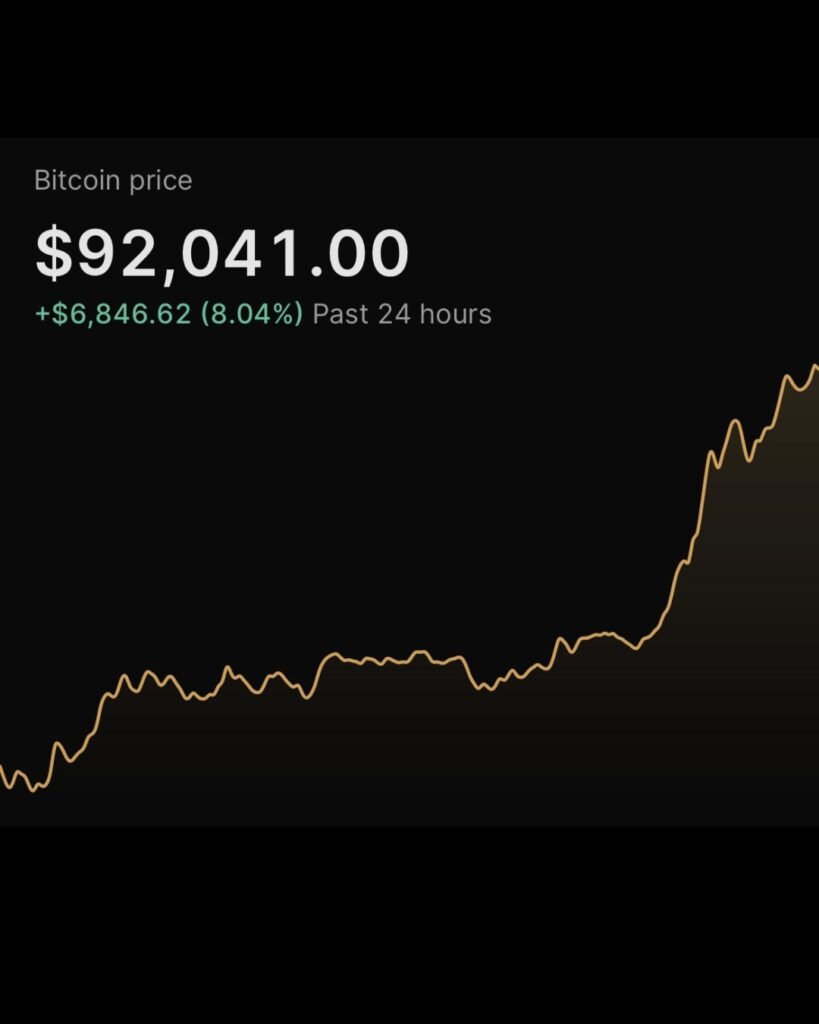

Bitcoin showed cautious upside, trading above key support and testing higher levels as bulls attempt control.

- Introduction: Bitcoin’s “Cautious Ups

The price movement in Bitcoins has been characterized by a mixture of optimistic and uncertain conditions in most cases. When analysts state that Bitcoin illustrated a “cautious upside,” this indicates that:

Prices are moving upwards, but

The buyers (Bull) are not too aggressive, and

The market is waiting for confirmation before fully committing.

This is normally after periods of intense volatility, significant news announcements, or periods of consolidation. Rather than having spectacular rallies, it is characterized by gradual movements of Bitcoin while respecting significant levels.

In this context:

Unless otherwise stated, all prices and shares are in U.S

Testing higher levels:

In the case of Bollinger Bands

Bulls showing control signals a fight amongst traders rather than a win for the bulls

This is a very important transitional phase which may be followed by either a strong break-out or a sharp rejection.

- What Are “Key Support Levels” and Why They Matter

2.1 Definition of Support

A level of support is the value where there has been more buying than selling activity in the past. As soon as the price of Bitcoin is near the level of support:

Buyers believe price is cheap

Description

Sellers. Reduces selling.

Price tends to stabilize or bounce

Critical levels of support are typically established by:

Previous Price Bottoms

Highly traded volume areas

Moving averages (50-day, 100-day,

Psychological round numbers: Psychological numbers have the same effect regardless of

2.2 Bitcoin Trading above Support: What It Means

When Bitcoin is moving above the crucial supports, it indicates:

Confidence in the market

Investors are not panic-selling

Dips are being bought

Less chance of losses

“Bears unable to push price below”

This phrase

- The stop loss clusters below the supports remain valid

Institutional comfort

If

Big players like buying above strong support

Indicator of stability, not vulnerability

A condition necessary in a bearish movement could be holding above support.

- Meaning of “Testing Higher Levels”

3.1 What Are Higher Levels?

“Higher levels” are:

Previous resistance zones.

Latest swing highs

Fibonacci retracement levels

If

Psychological barriers

(Example: $45K

Testing these levels means Bitcoin is exploring regions where there was once unambiguous selling pressure.

While this is happening, there are certain other points that need to be addressed for

Markets do not always behave in a straight line manner. Test the resistance level, as this can be significant because

It prevents the absorption of selling pressure

Weak sellers exit positions

Strong Buyers accumulate slowly

Despite the rejection based on the prominence of price, the repeated tests result in a weakening of resistance.

This cautious behavior:

Prevents overheated rallies

Encourages healthier market structures

In

Reduces the potential for crashes later on

- Bulls “Attempting Control”: Market Psychology Explained

4.1 Who Are the Bulls?

In Bitcoin markets, the bulls are:

Retail Traders Buying Dips

Long-term holders (HOD

INSTITUTIONS AND FUN

Algorithmic and Derivatives traders

Bulls try to control by:

To support

Forcing short liquidations

Up Moves | Increase Volume on Up

ü 4.2 Why Control Is Not Immediate

Even in bullish markets, control is obtained slowly, since:

Sellers take profits at resistance

Throughout the

Long positions release gradually

Macro uncertainty prevents aggression

These factors result in

Tricky market conditions

When

“Small higher highs”

$a$ to

This is positive, not weak.

- Technical Analysis Behind a Cautious Upside

The

5.1 Moving Averages Confirmation

Bitcoin trading above:

50-day MA → short-term bullish

100-day MA – medium-term strength

200-day MA → Long-term bullish pattern

A cautious forecast may happen when:

Price is above short-term MAs

Testing on 200-day MA

It causes hesitation but optimism.

5.2 Volume Behavior

Positive healthy cautious upside looks like:

Increase in volume on green candles

Less volume in the pullback phase

That means:

Buyers are loyal

B.

Sellers are not convincing

They

While low-volume breakouts may be a high risk, a growing number of shares on the positive side can help

5.3 Indicadores del RSI

Relative Strength Index (RSI) is often:

Between 50-65

Avoids overbought (>

These represent:

Controlled Buying

Control

No speculative frenzy

In

These conditions facilitate longer-term bullish moves.

- On-Chain Data Supporting Cautious Strength

6.1 During cautious upside:

Holders with long holding periods do not aggressively sell.

Coins are idle

Supply shock potential rises

This leads to a decrease in the available amount of Bitcoin.

6.2 Exchange Res

Reducing exchange reserves signify:

Bitcoin’s switch to cold wallets

The rise of

Less immediate selling pressure

This supports price, even for slow momentum.

Why does price continue to move upward

6.3 Removing the Distributional

Whales usually:

Add during consolidation

Avoid Chasing Breakouts

Buy near strong support

This helps in building the foundation for possible rallies.

- Derivatives Market Influence

7.1 Funding Rates

Cautious upside usually goes with:

Lack of, or slightly positive, funding

Lack of excessive leverage

This is healthy because:

Fewer Forced Liquidations

Reduced chances of an accident happening

7.2 Open Interest Trends

Slow rise in open interest indicates:

New positions entering carefully

Market confidence increasing

Rapid increases carry some risk, while consistent growth helps to reinforce the trend.

- Macro Factors Influencing the Cautious Att

8.1 Interest Rates and Inflation

Bitcoin is highly sensitive to:

Central bank policies

Now,

Inflation data

Bond Yields

When macro signals are inconclusive:

Conservative

Bitcoin increases tentatively

Also

Investors hedge rather than speculate

8.2 Equity Market Correlation

Bitcoin can reflect:

Nasdaq sentiment analysis

Market environment: Risk-on/risk-off

The rate at which stocks increase will be matched by the slow increase in Bitcoin.

- Why Cautious Upside Is Healthier Than a Sharp Rally

Explosive rallies may result in the following:

Overle

Retail FOMO

Sudden Crashes

Cautious Ups

Creates good support zones

Removes weak hands steadily

Encourages long-term involvement

“In the past, the biggest bull runs for Bitcoin began quietly.”

- Possible Scenarios Ahead

10.1 Scenario de Continu

If Bitcoin:

Holds Support

Resolves resistance with volume

Keeps RSI above 50

Then:

Momentum increases

New highs can now be expected

Confidence tricksters are back en

10.2 Consolidation

Bitcoin could:

Range between Support and Resistance

In a Forex market

Frstrate traders

Accumulate energy

This is neutral-bullish and often precedes breakouts.

10.3 Rejection and Pullback Scenario

If resistance holds:

Short-term pullbacks happen

Support is resubmitted

As long as the level of support is maintained, the structure is considered to be

- What This Means for Different Market Participants

11.1 For Long-Term

Accumulation zones are still in effect

Risk-Reward ratio: Risk

“ PATIENCE IS KEY”

11.2 For Swing Traders

Trade support-resistance range

Manage the risk tightly

Avoid Overuse of Leverage

11.3 For Content Creators & Analysts

This stage is informative

Stress risk awareness

Avoid hype narratives

The

- Historical Comparison

Bitcoin has exhibited the same pattern:

Before major bull runs

After Protracted Bear Markets

Near cycle midpoints

In many cases:

Upside was slow and measured, which caused rallies that spanned multiple

- Final Summary The statement: “Bitcoin demonstrated cautious gains, operating above significant support and testing higher levels as the bulls try to take control,” the market is growing, with growing demand for the product or service, producing the following effects Good technical knowledge **Disciplined Buying Behavior Risk sentiment: balanced Strengthening confidence, while avoiding speculation

In This is not weakness; this is preparation. Markets that move upwards incrementally can sustain for a longer period of time and reach higher levels in a stable manner.